High labour input service industries should focus on their most significant cost: labour.

The pressure invoked by the recent IR laws and regulations by the Federal Government in Australia has moved the dial from business apathy and indifference to the need for accuracy in interpreting the employee’s award. Accuracy in payroll needs to be a key business focus.

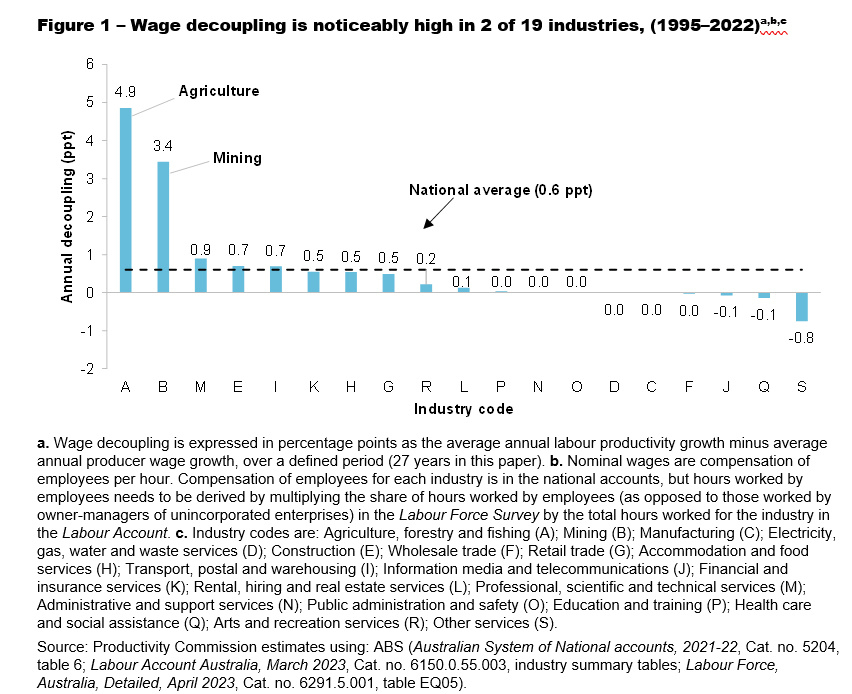

The latest Productivity Commission report, which highlights the negative outcomes of the past 25 years in high labour-utilising services and other industries, is a sobering read.

The services industry has recorded the lowest productivity growth in the past 25 years, at -.08%, compared to mining’s +3.4 % and agriculture’s +4.9%. What is going wrong?

Services are labour-intensive and, therefore, dependent on the output of people.

Proactivity improvements in the services business are falling behind due to 2 factors: wage costs and the lack of focus on eliminating repetitive and manual labour processes. As wage costs have not. In the past years, the pace with the CPI has not been maintained, which can be reflected in the lack of productivity in the businesses. That is, it takes employees more time to get things done than ever before. This is an incredible fact based on the expansion of computerisation in the past 25 years; why is it so? There will be many reasons, but let’s focus on one we can address. Removing error-prone manual data and process activity within our businesses

The # 1 is labour cost management, and the #2 is core processes like payroll. Both have contributed to negative productivity over the years.

Labour $ costs are impacted on by the business process design and its management as much as the rate paid.

The Inzenius model can control employee rostering and award-compliant payroll processing time and effort.

Let’s focus on these two addressable productivity and cost reduction processes in light of the current drive for legislative compliance on the pay conditions side of the equation. The pay rules and conditions are out of our control, but the productivity of our rostering and payroll teams is not.

As the Productivity Commission paper quoted, “Thus, over the long-term, wage decoupling meant average real annual wages were about $3,000 lower in 2023 than they would have been without decoupling. But higher productivity growth dominates this effect and is far more material, even if the presence of the decoupling we observed. Indeed, if productivity growth had returned to levels previously seen in the 1990s (of 2.2%) real annual incomes would today be just over $25,000 higher.

In other words, the impact of boosting productivity far outweighs the impact of bridging the observed productivity wage gap. And importantly, productivity remains the key to continued wage growth and long-term prosperity.”

Assess the full Productivity Commission Paper

https://www.pc.gov.au/ongoing/productivity-insights/productivity-growth-wages