Automated Payroll System

Reduce calculations and errors with our payroll solutions. Our payroll system generates accurate payroll reports from employees’ electronic timesheets.

Efficient and Integrated Automated Payroll System

Compliant Payroll Management System

![]() Automated payroll calculations from approved timesheets

Automated payroll calculations from approved timesheets

The process reduces the need for manual conversion of the time works in the timesheet to the various pay categories for each employee shift components and in aggregate for the pay period. employee

![]() Reducing errors of payroll processing

Reducing errors of payroll processing

Automated award interpretation efficiently reduces the risk of data calculation omissions and errors.

![]()

Improved employee satisfaction

Employees are never happy with pay errors and the provision of accurate pay for each employee based on their accepted timesheet records ensures their satisfaction.

![]()

Comprehensive reporting capability

Dynamic reporting with business specific dashboard creation capabilities across the entire enterprise delivers powerful dynamic data for analysis and better decision making.

![]()

ATO Single Touch Payroll (STP2) & IRD Payday Filing compliant

The Australian and New Zealand Tax offices have moved to dynamic reporting directly from the payroll system itself. Inzenius is approved for ATO STP2. It is a requirement of payroll processing.

Future information transfer requirements may include hours worked in each category.

We believe that the inclusion of hours to each pay category is a key desire of the ATO and other government agencies. We also believe that it will be required and that is why we have designed Inzenius from the ground up to deliver this capability in readiness for that time. That’s Inzenius

“There are quite a few factors to take into consideration when government is considering “hours worked” to be included in future phases of Single Touch that is sourced from data in PAYROL

Deanne Windsor – Single Touch Payroll Lead at Pendragon Consultants.

Single Touch Payroll 2 Compliant

Automated rostering to payroll

In the 2019, the government announced that STP is expanded to include additional information to:

- reduce the reporting burden for employers who need to report information about their employees to more than one government agency

- support the administration of the social security system.

STP Phase 2 sends to the ATO, directly from the payroll system data the ATO needs including:

- details of the remuneration each employee’s pay

– the type of income for the employee (such as salary and wages, or working holiday maker income)

– the components which make up the amounts (such as gross pay, paid leave, allowances or overtime) - details of each employees pay as you go (PAYG) withholding

– the amounts withheld from payments like tax and other deductions.

– information about employee calculated amounts, which is currently provide by sending a copy of the employee’s TFN declaration. - super liability information.

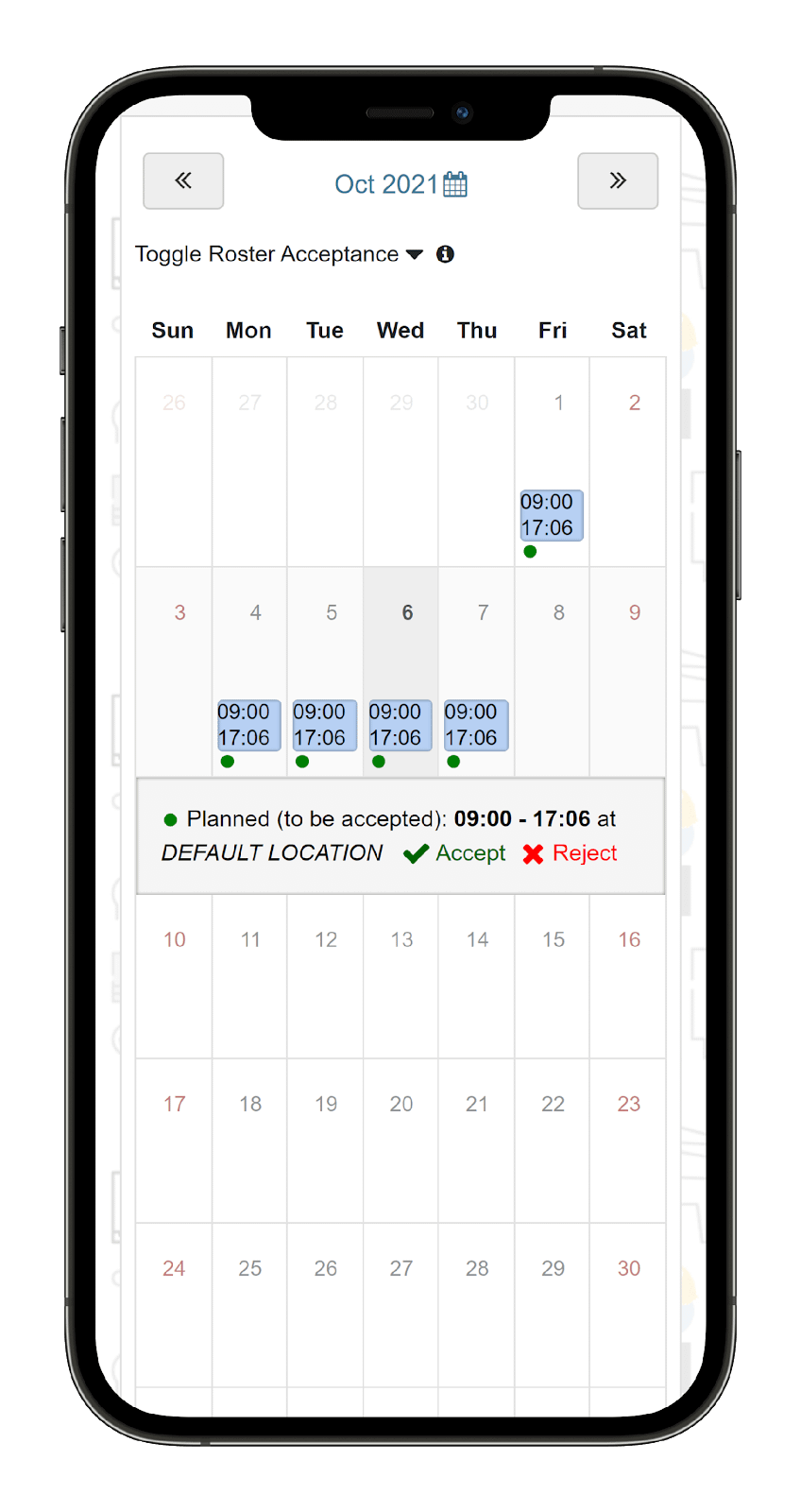

Electronic Automated Timesheet Software

Employee electronic Timekeeping records are validated against their Rosters for each shift, creating an electronic timesheet for sign off and management approval, automating times worked for Payroll.

The employee will have direct access to the times approved on their device for follow up prior to payroll production if required.

Generate accurate payroll reports to validate pay data before processing to ensure accurate remuneration

Easily pay your employee wages using standard ABA bank files, and superannuation contributions through your preferred clearing house

Report directly to the ATO and/or Inland Revenue, with report data derived directly from the payroll data procossed in Inzenius’ payroll system

Testimonials

How Inzenius works for others like you

Inzenius customers operate across a wide range of industries, from hospitality to health care. See what some of our valued customers have to say!

It's All About Service - That's Inzenius Payroll Support

As is the case for many companies, back pay calculations are required to be processed to identify any underpayments.

Inzenius has helped many companies re-run and sample and, in some cases, their entire timesheets through the Inzenius Award Interpreter to identify what the employees should have been paid under their award for comparison against what was paid for forensic auditing.

One such company, Save Group HR Consultancy, came to Inzenius for help.

In less than two days, the results of the test award samples were returned, identifying underpayment, after which an entire run going back many days was requested.

'I have been struggling with a back pay project for ~12 months. The Inzenius team responded to my query and provided the requested data within a day – exceptional service and a great software that will assist a lot of business'!' Bianca Toce People & Culture Advisor Save Group.

Inzenius efficiently solved the problem of auditing past payroll to award compliance, saving substantial time and costs.

Inzenius's renowned responsiveness is typified in this case, highlighting the value of not only Inzenius's payroll efficiency but, more importantly, the level of service provided.

A leading service industry client benefited from working with the Inzenius team

The management needed to achieve improved staff scheduling, award compliance, management practices and costs consistent with the requirements of a high-quality services industry environment.

The management needed to achieve improved staff scheduling, award compliance, management practices and costs consistent with the requirements of a high-quality services industry environment.

Management looked to improve the staff allocation, costing and timesheet management to payroll processes. Their system was inefficient in its data capturing and authorizing processes of employee worked times and did not dynamically compare actual times worked to plans. Inzenius improved the process of activity costing, productivity reporting, and the employee worked time authorizing that included a streamlined billing process.

“Inzenius’ technology and software products streamlined staff management through billing and payroll. It allows for simplified roster development, time validation, to award interpretation. It makes it simple to quickly identify who works where and at what times, which is key in the hospitality industry.

Now each of our properties is saving time in development and improving the quality of their rosters. Data capture for productivity reporting and billing is integrated with the Employee Time & Attendance approval process.

The payroll processing function for over 5,000 + staff at 150 sites across Australia absorbed over 11 FTE’s It now requires 2.5 FTE’s.

“The Inzenius team worked with our management to incorporate the added productivity improvement features into Inzenius for us,”

Racing premier sporting and function venues operator upgrades to Inzenius 2023 Event and Venue Rostering, Timekeeping and automated Award Interpretation Payroll system.

Racing premier sporting and function venues operator upgrades to Inzenius 2023 Event and Venue Rostering, Timekeeping and automated Award Interpretation Payroll system.

The various venues managed by the group had been using a rostering process that required substantial time and effort to build schedules for each event and notify staff of their required attendance. They did not capture actual employee attendance times for comparison to rosters, requiring substantial manual time data entry for payroll processing. All these functions have been automated seamlessly, improving the accuracy of event costing whilst reducing the time and cost of rostering through to payroll production.

“Inzenius’ technology and software products streamlined the process of staff management. It allows for a range of rostering processes, including automatically building rosters based on the event attendance and times, web-based employee roster notification and acceptance to each employee device streamlining communications. Time & attendance validation, automated electronic timesheet production based on validation of times worked back to the planned roster through to payroll production in one application”.

Inzenius software products are particularly suited for event-based businesses providing a seamless single code-based, enterprise-level application that can easily scale for larger organizations with multi-site operations.

Inzenius Software Product Suite:

- Employee Onboarding

- Auto and manual roster development

- Web roster notification

- Award Interpretation

- Time & Attendance

- Automated Payroll from Approved Timesheets

- Reporting Services

Inzenius Patented Award-winning Payroll with Automated Award Interpretation from the Systems Timesheet or Rosters.

The Inzenius team began their journey of designing and patenting its award-winning payroll system software based on the team’s experience in implementing innovative employee management systems for prestigious clients such as O’Brien, Crown Resorts and Spotless.

Inzenius’s ability to automate any number of payroll interpretation conditions is its core advantage in service industry markets.

The Inzenius in-house development team maintain currency of automation of the ever-changing payroll rules for the Australian New Zealand market.

FAQs

STP Events only include Year to Date data. Each time a Pay Run is committed and the STP Event is submitted, the Year to Date data for each employee is updated with the Pay Run(s) figures.

If an employee has not been processed through the Regular Pay Run, and they have no Manual or Rebank Pays for the same Pay Period, they will not be included in the STP Event. Conversely, if an employee has not been processed through the Regular Pay Run, but a Manual or Rebank Pay for the same Pay Period has been processed, they will be included in the STP Event.

The exception to this is, of course, when finalising the Financial Year. When flagging a Regular Pay Run with the “Final Event Indicator”, all employees who have been processed in that Pay Run Schedule for the Financial Year will be included with the “Final Event Indicator” marked accordingly.

No. Due to the grouping of “Regular Wages” (Regular, Manual, and Rebank Pays), once the STP Event has been submitted for a Pay Period it cannot be re-submitted with new Pay Data.

Manual and Rebank Pays created after the Regular Pay Run has been processed should be assigned to the next Pay Period

Process a Manual or Rebank Pay, assigned to the next Pay Period, to correct the wages and this pay will be submitted in the STP Event with the Regular Wages for the next Pay Period.

Employers must provide the Final Event Indicator for all employees by the due date of 14th July in the following Financial Year (unless a deferral has been granted). If within this time frame, Manual, Rebank, ETP, and Final Pays can still be processed to rectify any incorrect wages. Clients should email Inzenius Support (support@inzenius.com) for specific advice pertaining to their situation.

To re-finalise EOFY:

- If submitting Regular Wages (Regular, Manual, or Rebank Pays), select the Regular Pay Period and flag the “Final Event Indicator” option. Submit as an “Update Event”.

Yes – there is one major change to reporting, and that is with Fringe Benefits (FBT). STP requires the employer to submit FBT as “Exempt” or “Taxable”, depending on the employer’s circumstances.

- If the employer is an exempt business, all Employee File FBT figures should be entered in the “FBT Exempt” field.

- If the employer is not an exempt business, all Employee File FBT figures should be entered in the “FBT Taxable” field.

- If the employer has multiple Pay Run Schedules, of which are both Exempt and Taxable, Employee File FBT figures should be entered according to whether the Schedule/ABN is Exempt or Taxable.

Note: FBT figures can still be entered during the End of the Financial Year, as per the annual release notes for EOFY (released in May of each year). This will not affect STP (reporting will be via an Update Event as a part of the finalisation process at the end of the financial year) and instructions on adding these figures in are included in the EOFY Release Notes.

An automated payroll system is a system that includes direct full payroll processing from approved timesheets.

The key advantages of an automated payroll system are reduced effort and risk of errors in payroll processing and distribution as well as beeter cross business labour management.

An electronic timesheet is a timesheet that captures employee times worked at each GPS verified location, the times checked against the employee roster variance authorisation by supervisors, and signed off by the employee via other devices.

The electronic timesheet is a daily record of the employee times approved as worked as stipulated by FWO and must include the managers and employee sign-off. It provides the details for the payroll calculation with the rules of the particular award.

Payroll is a function of most businesses with statutory Interpretation of the payment based on the approved and accepted number of hours each employee works each day.

By automating the payroll the time taken by payroll staff is reduced with the added benefit of the automated award interpreter reducing the time in data calculation and entry as well as the risk of errors and omissions.

The pricing for the system is based only on the number of employees paid in each pay period, not the total number of employees on the system. This can be converted into a monthly or annual fixed license.

Manual systems often require the payroll team, to sum up, the times and hours each employee works in a shift to be added to payroll classes configured in the Payroll system. Automated interpreted payroll removes these activities by using the time in the employee timesheet for creating the required amount to be paid in the payroll.

The system is secured on the client’s network or is hosted on the cloud behind the hosting security protocols. In all instances, the security access requires multi-factor accreditation for signing in.

The payroll will facilitate additional or appended to the next pay adjustments for any category of reasons.

The timesheet approval is a process that which the supervisor can auto approve all matching to roster timekeeping records and then be presented with any timekeeping that is at the variance of the roster for approval. These can be undertaken daily presenting the approved times on the employee device for their electronic acceptance. Both employer and employee sign-off of timesheets is a statutory requirement.