Ordinary Times Earnings (OTE) in payroll Award Interpretation and statutory reporting and compliance are complex as they have different applications in different components of wages for casuals, allowances, bonuses, superannuation, expense reimbursements, and leaves, as well as Payroll Tax and Workcover premiums by the state and eligible termination payments.

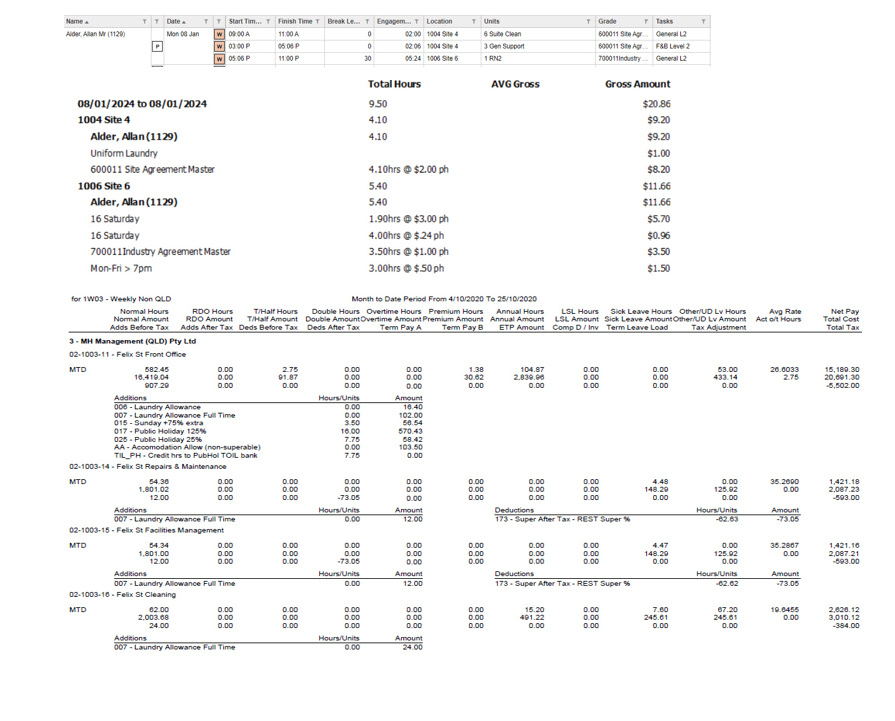

When you consider that each employee may be working at different times each day and in multiple roles in each shift on different award and leave conditions you see why the graduality of the Inzenius award interpreter is so critical in getting payroll right. Inzenius granularity automates the application of OTE to each transaction within and shifts or engagement within them. This automates the accurate payroll OTE calculations from the approved timesheets.

The definition of OTE in most awards is as follows. Still, it can be varied in Enterprise Agreements or in employee individual agreements to reflect the standardised employee wages and salaries to incorporate some overtime payments into the employee’s base wage. back to and pays.

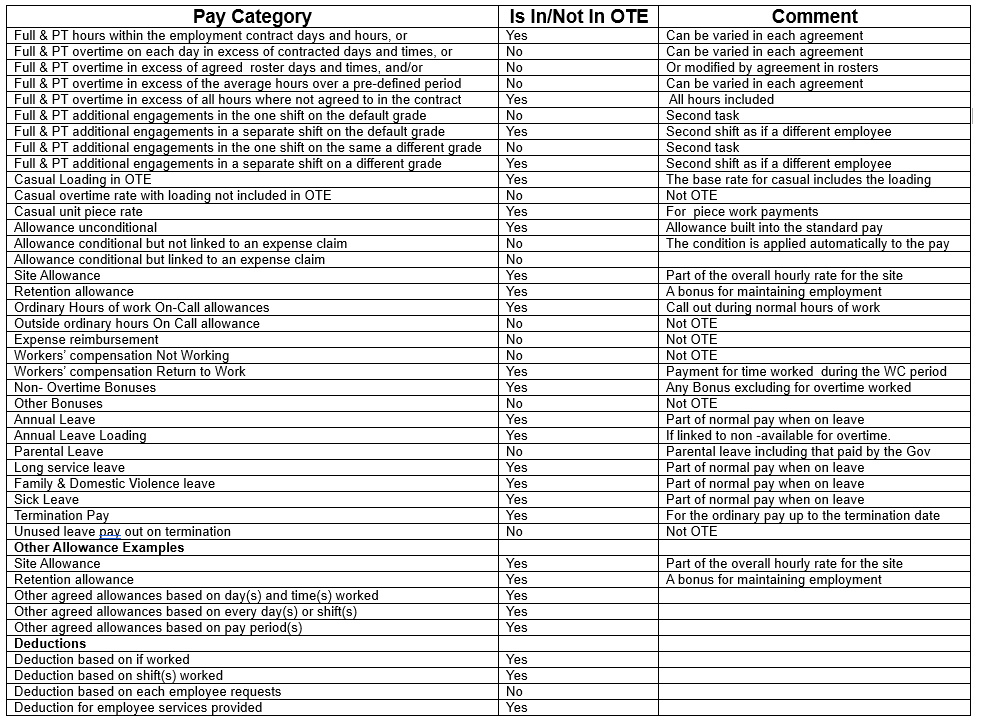

Typical Inclusions for OTE

Example: overtime identified in award or agreement

Ennio is employed under a collective agreement that incorporates terms from an award. If there’s inconsistency between the agreement and the award, the agreement prevails.

Under the award, the ordinary work hours are 38 hours per week, and the employer can require an employee to work reasonable overtime. However, the agreement provides a shift roster in which employees work an average of 44 hours per week. The shift roster identifies the ordinary work hours as 40, with the additional four hours paid at a penalty rate.

The payment to Ennio for his 40 ordinary hours of work is OTE. The 4 hours of overtime payments are not OTE.

The payment for all 44 hours is salary or wages because it is a reward for his services.

Inzenius has the capability to automate the compliance to these definitions even where the employee may work under different components of the shift in one day, as presented below.

OTE For Superannuation

Use OTE to calculate the minimum super guarantee contribution for your employees. OTE is the amount you pay employees for their ordinary hours of work, including commissions and shift loadings.

Salary and wages to work out the super guarantee charge. You only need to do this if you missed paying the minimum super guarantee contribution by the due date. Salary and wages are similar to OTE but include overtime payments in the same shift with different payroll interpretations.