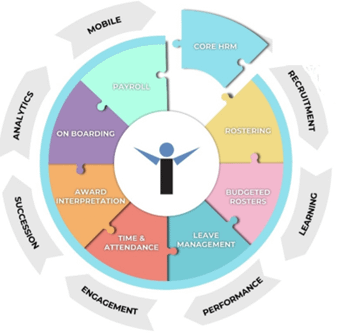

Payroll Need Award Interpretation Automaton and Streamlined Workflow

Payroll professionals are required to deliver 100% accuracy in everything they do to perform their duties; every day of every week of every year.

Their ability to accurately interpret the payroll is incredible and with the many changes being introduced by the government is making their role even more difficult.

The challenges do not end at payroll award interpretation. Many other industrial relation rules including work time payment and allowances, leave management and other regulation incorporated in the appropriate instruments.

The capture of required records including detailed times worked as approved by management and accepted by each employee is the pivotal data record for the correct interpretation of the payroll.

Refer FWO web site: https://www.fairwork.gov.au/pay-and-wages/paying-wages/record-keeping

Roster & Timesheet Publication

- rosters to be published in advance as per the industrial instrument

- published and provided to each employee to acknowledge

- when the employee started and finished the overtime hours

- only modified with employee approval

- to be used for validation of actual times attended and recorded in timekeeping

- creating the timesheet

- to be submitted to each employee for their acceptance.

- and used for the calculation of the payroll

Payroll

- pay rate paid to the employee

- gross and net amounts paid

- any deductions from the gross amount

- details of any incentive-based payment, bonus, loading, penalty rate, or other monetary allowance or separately identifiable entitlement paid.

Hours of Work

- the classification worked including casual or irregular part-time employee who is paid based on time worked.

- a copy of the written agreement if an employer and employee have agreed to an averaging of the employee’s work hours.

- any penalty rates or loadings paid to employees for overtime hours worked, including:

- the number of ordinary, penalty and overtime hours worked during the day or over a period

- when the employee started, finished an unpaid break duration

- any time worked loadings such as day of week, night, or other loadings or penalties

- Anny other allowances as part of the instrument.

Leave

- any leave taken

- leave to be accrued based on fixed days per period or on actual hours worked

- how much leave an employee has after each pay period.

Superannuation Contributions

- calculation entire based on employee’s standard or actual hours worked.

- amount paid each pay run

- pay period

Individual Flexibility Agreements

If an employer and employee agree to an individual flexibility agreement under an award or registered agreement, a record must include both:

- a copy of the written agreement

- a copy of any notice or agreement to terminate the flexibility agreement.

- what Award is relevant for the undertaking of the Better Off Overall Test

- periodic assessment of the employees pay to the award.

Today this interpretation can be automated, efficiently and accurately completing the payroll processing from automated interpretation for the approved timesheet.

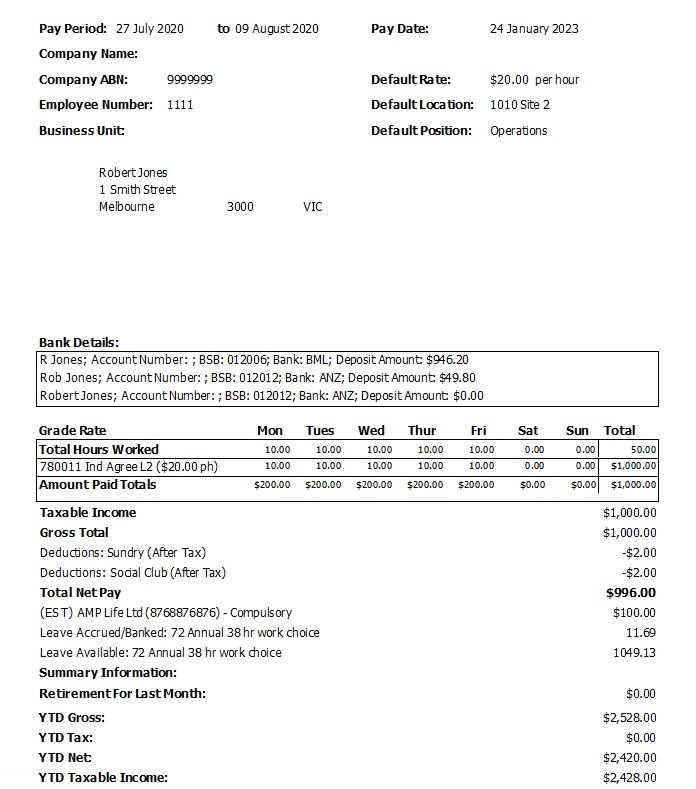

Pay slip

Pay slips should include:

Refer FWO web site https://www.fairwork.gov.au/pay-and-wages/paying-wages/pay-slips#what-pay-slip-should-have

- employer’s and employee’s name

- employer’s Australian Business Number (if applicable)

- pay period

- date of payment

- gross and net pay

- if the employee is paid an hourly rate:

- the ordinary hourly rate

- the number of hours worked at that rate

- the total dollar amount of pay at that rate

- any loadings (including casual loading), allowances, bonuses, incentive-based payments, penalty rates or other paid entitlements that can be separated out from an employee’s ordinary hourly rate. For example, a note could be included on a pay slip that the hourly rate incorporates the relevant casual loading.

- any deductions from the employee’s pay, including:

- the amount and details of each deduction

- the name, or name and number of the fund / account the deduction was paid into

- any superannuation contributions paid for the employee’s benefit, including:

- the contributions made during the pay period (or the amount of contributions that the employer intends to make)

- the name, or the name and number, of the superannuation fund the contributions were (or will be) made to.

Leave Balances on Pay Slips

Leaves can be shown on a pay slip but it is not a requirement

It may be good practice to show TOIL and Annual Leave to streamline leave requesting processes as employers do need to tell employees their leave balances if they ask for it.

#ThatsInzenius