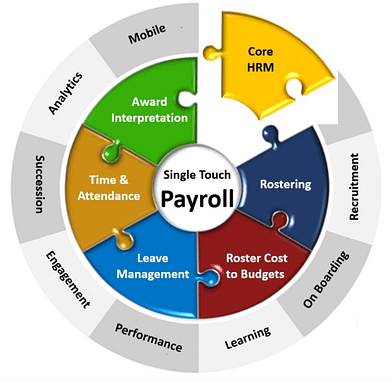

Why is the Inzenius All-In-One Rostering to Payroll System Right For the Times

Having the full Payroll and Employee Processes from Onboarding, Rostering, Time and attendance, Timesheet, Award Interpretation and Payroll from one, not just multiple system-interfaced processes, is a must. “The pitfalls of immature payrolls, particularly those stemming from a lack of integration, present significant challenges for any organisation striving to maintain efficiency, accuracy, and compliance in its operations” Ian Giles International strategist on payroll.

Inzenius was designed to deliver configurable Award Interpretation from the in-the-one-system Rostering and Timesheet to deliver roster cost control, process efficiency, compliance, accuracy, and in Payroll processing risk and time-saving.

The Full Article Published by Alan Giles

Many organisations still rely on immature payroll processes and systems that are either outdated or poorly integrated with other business functions. This lack of integration can lead to a multitude of problems, the most significant of which is not paying people.

Data inconsistencies, a common issue where disjointed systems result in conflicting information across different departments, not only lead to errors in payroll processing but also affect decision-making processes due to unreliable data.

As mentioned previously, the inefficiencies in workflows that arise from non-integrated systems often manifest as time-consuming manual processes, where data has to be entered multiple times across different platforms, leading to increased chances of human error and reduced productivity. The impact of these inefficiencies on overall business performance and employee morale is explored, emphasising the importance of streamlined processes for organisational success.

Another critical pitfall is the challenge of compliance and legal issues. Immature payrolls, lacking proper integration, struggle to keep up with ever-changing tax laws and regulations. This can result in costly legal penalties and reputational damage, making compliance a major concern for businesses.

Immature payrolls frequently operate in isolation, often disconnected from other country payrolls, and other functions within an organisation. This lack of seamless integration results in disjointed processes that significantly impede the flow of information and coordination.

Such fragmentation often leads to data discrepancies, as the same information might exist in multiple places with varying degrees of accuracy. This scenario not only complicates the payroll process but also affects the overall efficiency of HR and financial operations. Inaccuracies in data can lead to payroll errors, compliance issues, and a general lack of trust in the system from both employees and management.

This article aims to provide an understanding of the challenges posed by immature, non-integrated payroll systems and serves as a precursor to the ongoing discussion on innovative solutions that can revolutionise payroll management in contemporary businesses.

Here are 10 of the top issues organisations face when integration falls short of the mark, and 10 tips on how to overcome them:

Data Silos – Inzenius has the data in the one system

Data silos are a critical issue in immature payroll systems, where isolated operation leads to compartmentalised stores of information. These silos obstruct the efficient flow of data between different departments, such as HR, benefits, finance, and payroll, impeding collaborative and informed decision-making. The lack of interconnectedness means each department operates with a limited perspective, unaware of potentially valuable insights residing in other parts of the organisation. This compartmentalisation not only reduces operational efficiency but also hampers the organisation’s ability to respond cohesively to broader business challenges, ultimately affecting overall performance and strategic alignment.

TIP

Look at how you connect: To effectively address data silos in payroll, you need to integrate payroll and HR management systems. Such a solution will centralise data storage and processing, allowing for seamless information sharing between payroll and other HR functions like benefits administration, time tracking, and employee records management. By breaking down these silos, data can flow freely across the business, ensuring consistency, accuracy, and real-time updates. Introducing, or improving integration not only streamlines processes but also provides a unified view of employee information, enhancing overall efficiency and decision-making capabilities within the organisation.

Manual Data Transfer – Inzenius has the data in one system.

The absence of integration in payroll often necessitates manual data transfer, a process fraught with risks and inefficiencies. This labour-intensive task involves manually inputting or transferring data between payroll and other organisational systems, such as HR and finance. Each manual intervention introduces the potential for errors – from simple data entry mistakes to more significant discrepancies. These errors not only consume valuable time in detection and correction but also jeopardise the accuracy and reliability of critical financial and employee data. Consequently, this inefficient method of data handling can lead to operational delays, increased workload, and a heightened risk of inaccuracies that impact the entire organisation.

TIP

Automate Data Synchronisation: To improve the process of manual data transfer in systems, invest in automation tools that enable data synchronisation between different systems. Automation software can seamlessly transfer data from time tracking, HR, and finance systems to the payroll system, minimising the need for manual entry. This not only reduces the risk of errors associated with manual data transfer but also significantly speeds up the process, ensuring timely and accurate payroll processing. Automated data synchronisation enhances efficiency and reliability, freeing up valuable time for staff to focus on more strategic tasks.

Inconsistent Information – Inzenius has all the data in one system.

Disjointed processes in immature payrolls frequently lead to inconsistent information across various departments, significantly impacting data accuracy. When payroll operates in isolation, without synchroniding with HR or finance systems, discrepancies inevitably arise. Different departments may hold varying versions of the same data, such as employee hours, salaries, or benefits, leading to confusion and inaccuracies. This inconsistency not only undermines the reliability of the data but also complicates decision-making, as leaders cannot base their strategies on fragmented or conflicting information. Ultimately, these inconsistencies can result in payroll errors, misinformed business strategies, and diminished trust in organisational data integrity.

TIP

Standardise Data Formats and Procedures: To combat inconsistent information in payroll, standardise data formats and procedures across all departments. This involves aligning the way data is recorded, processed, and stored in different systems, such as HR, finance, and payroll. Ensuring that all departments use uniform data entry formats, terminologies, and update schedules can greatly reduce discrepancies and mismatches in information. Regular cross-departmental meetings to align on these standards can further ensure consistency. This standardisation fosters uniformity in data handling, leading to more accurate and reliable payroll processing, and facilitates smoother inter-departmental communication and data integration.

Time-Consuming Reconciliation – Inzenius has the data in one system.

In the absence of integration between payroll, finance, and HR systems, the task of reconciling data becomes labour intensive and error-prone. Teams must manually compare and align payroll records with financial and HR data, a process that is not only time-consuming but also susceptible to inaccuracies. This painstaking reconciliation is required to ensure consistency across different departments, a critical step for accurate financial reporting and compliance. However, the manual nature of this task significantly increases the likelihood of errors, which can lead to further delays as additional time is needed to identify and correct these discrepancies, thereby straining resources and reducing overall operational efficiency.

TIP

Leverage Automated Reconciliation Tools: To address the issue of time-consuming reconciliation in payroll, utilise automated reconciliation tools. These tools can efficiently compare and reconcile data between payroll and other systems like HR and finance. By automating this process, you significantly reduce the time spent on manually checking and aligning data across different platforms. Automated reconciliation not only speeds up the process but also enhances accuracy by minimising the likelihood of human error. This leads to more efficient payroll processing, ensures consistency in financial reporting, and allows staff to redirect their efforts to more strategic, value-added activities.

Difficulty in Reporting – Inzenius has the data in one system.

The difficulty in generating comprehensive reports in systems with disjointed payroll, HR, and financial processes significantly hampers informed decision-making. Without integration, collating and synthesising data from these diverse sources into a coherent report is a challenging and often imprecise task. This challenge restricts the organisation’s ability to gain a holistic view of its operational health. Vital insights that could be gleaned from a unified analysis of payroll expenses, human resource metrics, and financial outcomes remain obscured. Consequently, leaders and decision-makers are deprived of the critical, consolidated information needed to make strategic, data-driven decisions, ultimately impacting the organisation’s agility and strategic planning.

TIP – Inzenius uses MS Power BI

Implement Advanced Reporting Software: To alleviate the difficulty in reporting within a payroll, implement advanced reporting software that can aggregate and analyse data from various sources. Such software should have the capability to pull in data from payroll, HR, and financial systems, providing a comprehensive view of all relevant information. With features like customisable reports, data visualisation, and real-time analytics, this software can transform complex datasets into clear, actionable insights. This not only streamlines the reporting process but also empowers decision-makers with accurate, up-to-date information, facilitating more informed and strategic decision-making across the organisation.

Compliance Risks Inzenius flexible and configurable award interpreter facilitates efficient compliance adjustments

Non-integrated payrolls significantly elevate the risk of non-compliance with tax and employment laws. In such solutions, updates or changes in regulatory requirements may be applied in one department but not seamlessly reflected across others. For instance, a change in tax legislation updated in the finance system might not automatically update in the payroll system. This lack of synchronisation leads to discrepancies in compliance-related data, increasing the organisation’s vulnerability to legal penalties and fines. Staying compliant requires constant vigilance and cross-checking across systems, a process that is not only inefficient but also prone to human error, further escalating compliance risks.

TIP

Conduct Regular Compliance Training and Updates: To mitigate compliance risks in payroll, it’s essential to conduct regular training sessions and provide updates for all staff involved in the payroll process. This training should cover the latest tax laws, employment regulations, and any changes in compliance requirements. Keeping the payroll team well-informed and up to date ensures that they are aware of and can correctly apply all relevant legal standards. Regular compliance training helps prevent unintentional violations and ensures that the payroll system adheres to current laws and regulations, thereby reducing the risk of legal penalties and fines.

Limited Visibility – Inzenius has the data in the one system.

Limited visibility is a significant issue for executives and managers in organisations with non-integrated payroll systems. The absence of real-time, unified data flow impedes their ability to gain a comprehensive view of the organisation’s overall performance. Critical metrics and insights, which are essential for strategic decision-making, remain obscured or fragmented across different departments. This lack of visibility restricts leaders’ understanding of the interplay between payroll expenses, employee performance, and financial outcomes. Consequently, it hinders their ability to make informed, proactive decisions, potentially affecting the organisation’s strategic direction, resource allocation, and ability to respond swiftly to market changes or internal challenges.

TIP

Implement a robust reporting and analytics system: Investing in payroll software or systems that offer comprehensive reporting and analytics capabilities will allow you to generate customised reports and dashboards that provide real-time insights into your payroll data. They help create standard payroll reports that cover key metrics that should allow you to drill down into the data to get more granular insights. Many come with dashboards (charts, graphs, and heatmaps) to make complex payroll data more understandable at a glance and feature automated alerts and notifications to proactively notify you of any issues, such as payroll discrepancies or missed deadlines. Ensure that the system can generate reports that demonstrate your organisation’s compliance status.

Employee Data Management Challenges – Inzenius has the data in one system

Managing employee data across multiple, non-integrated systems presents considerable challenges, marked by increased workload and the potential for discrepancies. Each system requires separate updates whenever there’s a change in employee information, be it a new hire, a promotion, or a salary adjustment. This redundant effort not only consumes significant time and resources but also heightens the risk of inconsistent data across different platforms. Inconsistencies might range from minor discrepancies in contact details to major differences in salary or job title, leading to payroll errors and confusion. These challenges undermine the efficiency and accuracy of employee data management, impacting both administrative processes and employee trust.

TIP

Implement a centralised and automated HRIS or payroll software: Consolidating all employee data into a single system can ensure that information is accurate, up-to-date, and easily accessible, eliminating the need to maintain multiple spreadsheets or paper records, reducing the risk of errors and data discrepancies. Modern HRIS and payroll software solutions often come with automation features that can streamline various processes, such as employee onboarding, time tracking, and tax calculations.

A centralised system can also enhance data security by allowing you to implement access controls and encryption measures. This helps protect sensitive employee information from unauthorised access and potential breaches. Many HRIS and payroll software systems offer robust reporting and compliance features. They can generate various reports, track regulatory changes, and ensure that your organisation complies with tax and labour laws, reducing compliance-related risks.

As your organisation grows, a centralised system can easily scale to accommodate new employees and additional data. This scalability ensures that your payroll and HR processes remain efficient even as your workforce expands.

Inefficiency in Benefits Management – Inzenius has the data in one system.

In the absence of integrated systems, managing employee benefits becomes a cumbersome and error-prone process. Each benefit, from health insurance to retirement plans, often requires separate administration and tracking, multiplying the potential for errors and inconsistencies. Without a unified system, ensuring that employees receive the correct benefits and that these are accurately reflected in payroll calculations is a complex and labour intensive task. This inefficiency not only leads to a higher likelihood of errors in benefit allocation but also creates frustration among employees and admin alike. It can result in incorrect benefit deductions or entitlements, affecting employee satisfaction and the organisation’s administrative efficiency.

TIP

Implement a self-service portal for employees: An ESS portal should allow employees to make benefit selections, update personal information, view coverage details, and access relevant resources and documents. Real time data ensures employees can immediately see the impact of their benefit selections or changes on their pay and coverage. Employees should be able to compare different plans and make informed decisions reducing the need for time-consuming back-and-forth communication.

Integrating the ESS portal with your HRIS or payroll system to ensure that benefit information is synchronised and accurate, minimising errors and duplications in data entry. An ESS portal empowers employees to take control of their benefits, reduce administrative overhead, and improve overall efficiency in managing benefits within your organisation.

Delayed Response to Changes – Inzenius design facilitates the efficient configuration of new regulations and rules with its configurable and easily updated Award Interpreter.`

In organisations reliant on non-integrated payroll systems, the ability to swiftly respond to changes in workforce dynamics or regulatory requirements is significantly hindered. Such systems lack the agility needed for rapid adaptation, resulting in delayed responses to critical changes. Whether it’s accommodating new employment laws, adjusting to market-driven salary trends, or integrating new employees, the lag in processing these changes can be detrimental. This sluggishness not only impacts operational efficiency but also affects the organisation’s competitive edge. In a fast-paced business environment, the inability to quickly adapt can lead to missed opportunities, non-compliance risks, and a diminished reputation in the market.

TIP

Establish a clear and proactive communication process: Ensuring that your employees know how and where to report any changes that may affect their payroll, such as changes in personal information, tax status, or direct deposit details is clearly important. Create a dedicated email address or an online portal where employees can submit payroll-related changes and inquiries. Make sure these channels are easily accessible and well-publicised within the organisation.

Send regular reminders to employees about important payroll-related deadlines, such as open enrolment periods, tax filing dates, and cut-off times for submitting changes. Use communication channels, including email, internal announcements, and bulletin boards, to reinforce these reminders. Provide resources, such as FAQs and guides, to help employees understand their role in ensuring accurate payroll processing.

Conclusion

The pitfalls of immature payrolls, particularly those stemming from a lack of integration, present significant challenges for any organisation striving to maintain efficiency, accuracy, and compliance in its operations. The siloed nature of these systems creates a fragmented landscape where data inaccuracies, time-consuming reconciliations, and compliance risks become the norm rather than the exception. The inability to seamlessly synchronise information across departments not only leads to inefficiencies and errors but also impedes the organisation’s capacity for strategic decision-making due to limited visibility.

Furthermore, the challenges in managing employee data and benefits underscore the operational inefficiencies that can erode employee trust and satisfaction. The labour intensive process of updating multiple systems, coupled with the high probability of errors in benefit management, highlights the need for integrated solutions that can streamline these processes. Additionally, the delayed response to regulatory changes or shifts in workforce dynamics further impacts the organisation’s agility and ability to stay competitive.

The cumulative effect of these challenges paints a clear picture: in the modern business landscape, where agility and data-driven decision-making are paramount, clinging to non-integrated, immature payroll systems is not just a minor inconvenience; it’s a critical business liability. Embracing integrated payroll solutions is no longer optional but a necessity for organisations looking to thrive in a dynamic and competitive environment.