Payroll non-compliance is a well-published issue with legislative and statutory investigations costing businesses $ Millions in back pays, and fines, not to mention the business reputational damage.

Underpaying staff is an employee demotivator in these days where staff are hard to retain and find.

Managers and Directors can be criminally charged for knowingly underpaying staff.

Payroll is either 100%, not 95% correct, and every employee, these days are encouraged to monitor their pay and report discrepancies to investigative authority like Unions the Wage Inspectorate, or Fairwork.

Business cannot contract out their responsibility for Payroll accuracy and directors in some states are able to be prosecuted for knowingly allowing Payroll non-compliance.

The way forward is to have the Payroll software include, Rostering, Time & Attendance, and Automated Timesheet with compliant Award Interpretation, including the Payroll processing in one system.

In the past 12 months, a business may have been obligated to comply with these new requirements:

- The Better Off Over Test (BOOT) where employees’ wages and conditions are set up to not disadvantage them as measured against the appropriate award conditions in their contracts.

- An annual reconciliation of their pay for each period needs to be undertaken with periods where they are disadvantaged against the award paid out each year.

- They will be required to maintain timesheets with start and finish and unpaid break times data, authorised and accepted by each employee.

- Annualised salary employees requiring their times worked checked against what they would have earned if on the appropriate award.

- An annual reconciliation of their pay for each period needs to be undertaken with periods where they are disadvantaged against the award paid out each year.

- They will be required to maintain timesheets with start and finish and unpaid break times data, authorised and accepted by each employee.

- Outer boundary of hours and penalty time worked not to be covered in salaries.

- This requires salary employees to be paid for hours in excess of the standard rates, (typically 12 hours overtime and 18 hours per week of non-base rate work times like Saturday, Sunday, and shift penalties). These are processed and paid in the pay run.

- They will be required to maintain timesheets with start and finish and unpaid break times data, authorised and accepted by each employee.

- Domestic violence leave entailments for all employees.

- Auto applies upon commencement and at each year of employment 10 days top up.

- If leave is taken to be paid at the same rates that they would have been paid if they worked including shift and non-Mon-Fri, overtime, and other award-loaded rates and penalties.

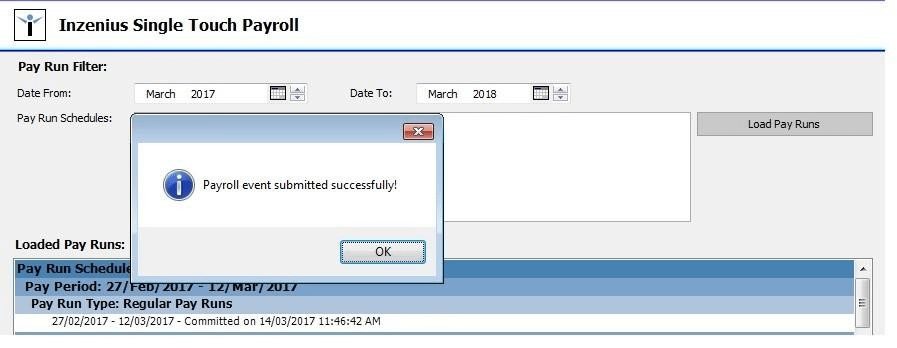

- STP 2 reporting compliance automation from the payroll, or use a third-party tool.

- ATO specified breakdown of pay categories being reported directly to the ATO portal via an approved tool.

- This process is to be applied for each pay run.

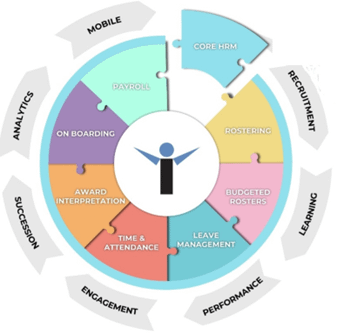

The key is to have a single system operating from one database to deliver Rostering, Timekeeping, approved Timesheets, automated compliant Award Interpretation, Leave management, and Payroll in one. That’s Inzenius.

You can build the interconnectors to the business broader business ecosystem as presented in the outer wheel.

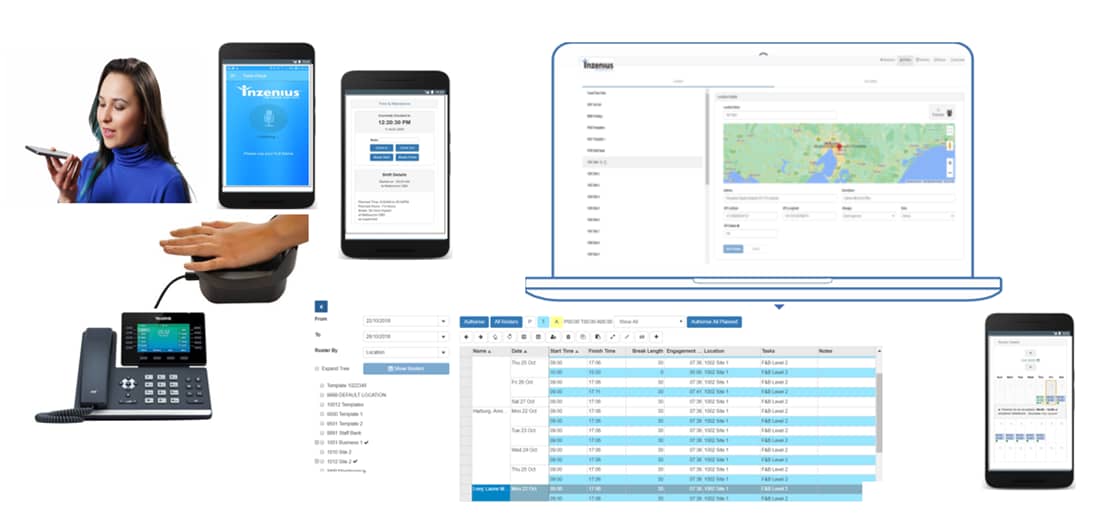

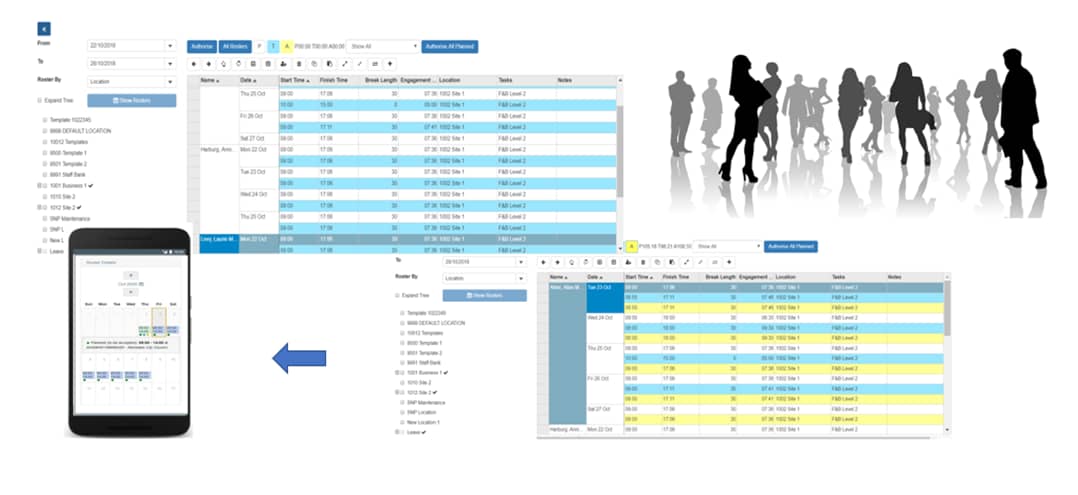

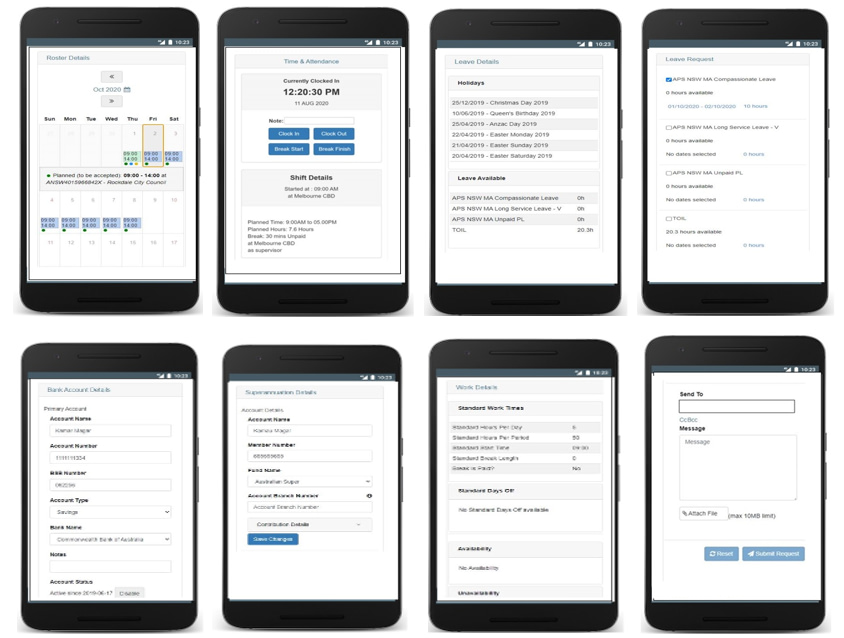

Rosters are easily built using the many Inzenius tools including templates that can be copied into the period for distribution to each employee’s device.

Roster easily built and distributed to employees devicse

Timekeeping can be easily captured via a range of processes from site landlines, to biometric timekeeping kiosks, and employee GPS-connected devices.

Employee time capture from any device aligned to rosters.

Timesheet authorization is easily undertaken by matching Timekeeping records to Rosters that are auto-approved with management sign-off. Variations to the Rosters are presented to management for their review and approval.

Timekeeping records compared to rosters for authorisation and Timesheet processing

Payroll and Leave Award Interpretation and processing automation through to Payroll distribution and ATO STP 2 reporting.

Payroll Processed all the way to STP reporting and distribution.

Employee direct communications with information flowing to and from their device is a great engagement tool set with substantial processes efficiencies.

Data and information flow directly to and from the employee’s device.

Inzenius offers an all-in-one out-of-the-box software solution that can be hosted in the cloud or delivered in an on-premises environment.

The Inzenius automated Award Interpreter delivers the most comprehensive compliant pay and leave processing.

#ThatsInzenius